Campervan depreciation – how much will my RV sell for?

Vehicles typically drop in value over time. The tired anecdote that the minute you drive your brand-new vehicle over the dealer’s threshold, it will lose £10k, is often true. This goes for brand new campervans too. But by how much? And are all affected?

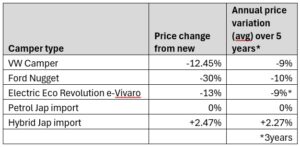

Our latest research reveals that campervans are remarkably resilient at holding their value, with some GOING UP in value. We found major differences between new and used base vehicle campers and between fuels.

We found that grey import Hybrid campervans (high-quality used base vehicles imported from Japan) are currently the biggest winners in terms of resale value. They not just holding their value, but are going up in price!

This is in part due to their dual appeal to people who want to go electric but unsure about EV technology and those who want to stay with the old fuel but want to reduce emissions and running costs (which is most of us, we assume).

We also found that other, non-hybrid grey imports hold their value too. This is possibly a strength of grey import campers as a whole and the fact they are ULEZ compliant.

Wider market data shows diesel and petrol camper prices vary a lot, with the VW California doing well but the Ford Nugget dropping the most.

The most important changes emerging are among the electric vehicles, with prices settling to levels typical of diesel campervans.

Age and mileage still key – depending on age

It will come as no surprise that price and mileage are key determinants of resale value. The younger and lower the mileage, the higher the value. While this is a well understood trend, there is more to the story. The age of a vehicle matters most when brand new. As new owners will confess, the biggest drop occurs the minute it leaves the showroom. The rate of the price drop then tapers off the older the vehicle gets.

This would explain the price stability of the grey Japanese imports prices. Our data shows that once a vehicle reaches a certain age and is ULEZ compliant, age is largely irrelevant provided it is not too high, leaving mileage as the most dominant factor, alongside condition. Mileage is only a factor if annual increases are over 10,000 miles.

Graph 1. Resale price variations in relation to miles driven

As Graph 1 shows, all of the vehicles surveyed that added under 10,000 miles since last sale, did not lose any value. Indeed, our data shows that the prices for some of these Japanese import campervans can go up – especially for Hybrids.

Electric vehicle price drop

An important trend recently has been the overall drop in new EV car prices. This is due to a number of factors, the biggest of which is newness – in other words EVs are new to the market.

As the market settles on EVs, their new prices have dropped to meet that of petrol and diesel prices – much to the annoyance of ‘early adopters’ of EVs who saw their Tesla’s and Cupra’s drop by 13% overnight in some circumstances.

This is not a recent phenomenon. The most striking example was the DVD player that dropped from £600 a unit in the early 00’s to £30 for a new one now.

Almost all new tech starts off high then settles as manufacturers recoup their initial R&D costs and efficiencies of scale and improved production efficiencies take effect. That and cheaper competition of course, will drive down prices.

Electric Campers stabilising

Electric RV prices are similarly coming down to meet the market value of standard vehicles while at the same time, the big manufacturers (eg Ford and Stellantis) are starting to see lower production costs as they crank up production.

Electric RVs are also relatively new to the market. We are seeing retail prices fall also. CampervanCo is the market leader in eRVs and prices have dropped significantly in the last three months alone. For example, we have seen a drop in the electric Eco Revolution from £74,995 to £64,995 twelve months later (13% drop) or down to £53,995 for a three year old vehicle (28% drop or 9% annually) – which, the CampervanCo sales team informs us, is lower in price than a similarly aged diesel VW camper. This is in part due to the emergence of lower price used base vehicles. This is good news for the market and the environment, as we see more people being able to afford zero-emissions touring. Bring it on!

The fully electric Eco Revolution is now cheaper than diesel VW campers of a similar age

Lastly, slower than expected demand for EVs has also played a factor in suppressing prices. But will this continue? Probably not. The trend of high demand followed by slower demand and a fluctuation in consumer confidence is an actual thing. This ‘thing’ or cycle is often referred to as a Product Life Cycle which typically peaks then tapers off.

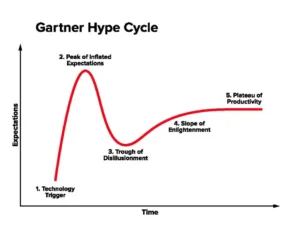

There is a specific cycle however for new innovative products called the Gartner Hype Cycle – see the graph below. Here a new innovation is generally hailed as the new messiah – the solution to all our woes at the beginning. This initial optimism however is often followed by dismay that it is not the saviour after all, but just another product, albeit useful or solving a problem (such as pollution and climate change). After public perceptions settle down and people weigh up the good and bad points of the product, demand and expectations pick up again (referred to as the Slope of Enlightenment) and then level out.

Graph 2 The Gartner Hype Cycle for new technology and related products

It seems from recent market trends, that we are currently at the start of the Slope of Enlightenment for EVs, with the market accepting these vehicles have their faults but that their benefits outweigh these and that we are ironing out some of the issues – such as a lack of charging points, costs and concerns about safety (please see our forthcoming article on EV safety concerns). This will be accelerated as many of the barrier issues are improved, such as charging infrastructure improvements and the low charging costs becomes more available.

Diesel is still the dominant fuel in campervans. And as a consequence, prices are still holding. The market however is shifting. With the new Labour government re-instating the 2030 deadline for the ban of new diesel and petrol vehicle sales and the roll out of low-emissions zones, resale prices are expected to drop precipitously within the next 24 months. For now though, prices are holding.

The winners – hybrid campervan prices GOING UP

Hybrid campers are the ultimate winners with values not only holding, but going up! CampervanCo’s ground-breaking Eco Pioneer I on average appreciates 1.7% per year in value. The newer Eco Pioneer II is even more impressive with it going up 2.84% on average per year!

With Hybrid vehicles remaining popular among the environmentally minded, we expect Hybrids to continue this trend for the foreseeable future. This will change however as the market, and legislation, moves away from the friendly Hybrid.

Hybrid Campervans such as the Eco Pioneer II are going up in price provided their mileage does not increase above the annual average

We predict that 2027/28 will be the pivot point. With the 2030 ban only two or three years away at that point, new owners of campervans, who typically own their vehicles for 5 to 10 years, will be concerned about demand for them when they come to sell. With the market expected to settle then for eRVs and prices roughly matching that of diesels, new buyers will be reluctant to buy diesel and opt for electric instead. This is expected to snowball.

The in-betweeners

The ubiquitous VW camper, eg the California does well and despite being diesel and bans and restrictions looming, tends to drop about £10,000 in the first a year then £2-3000 annually thereafter. Brand new ones will typically lose around £5,750 or 7.75% of their value in the first 6 months. A 12 month old California with around 11k miles will retail at £64,995 meaning in just 12 months it will lose £9,252 or 12.45% in value (from £74,242 list price). Not bad for a brand new vehicle. This confidence in diesel is not shared however by other brands.

The Losers

The story is not so good for Ford’s Nugget. A new Nugget, for example, can sell for around £85,746 and within a year and 7,000 miles later will typically sell for £59,950 losing a giddy £25,796 (based on current private ads on eg Autotrader)! That’s a whacking 30% drop in value – similar to a new family car, though not quite (see our comparison of car depreciation values below).

Accessories

Our research found that accessories play a subdued role in vehicles values. Data shows that the more extras you have, the greater the depreciation. In essence, factory fitted or even aftermarket accessories will half or even drop two-thirds in price from new – so the more you have, the more you will feel their depreciation in the overall resale price.

Fuel type

Market data for electric and hybrid vehicles demonstrates higher resale values than for petrol or diesel (see below). This trend is expected to accelerate once the urban and industry bans begin to bite. Expect this to eventually affect Hybrids as they begin to be excluded from Low Emission Zones and the manufacturer ban kicks in in 2035 for Hybrid.

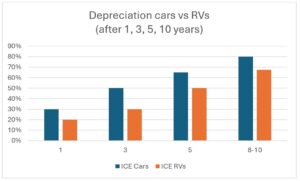

Car price depreciation is fierce in the first year, dropping a whopping 30% on average. By the time your vehicle is five years old, expect to be worth only 30-40% of its initial value. RV owners on the other hand expect these types of devaluation to occur after ten years of ownership and to fall only 20% in the first year (as an average).

Graph 3 – Depreciation for petrol and diesel cars versus RVs

Car and RV depreciation figures:

- Year 1: 15-35% depreciation.

- Year 3: 40-60% depreciation.

- Year 5: 60-70% depreciation.

- Year 8-10: 80% depreciation.

Compare this to recreational vehicles

- After 1 year: 20% depreciation.

- After the 3 years: 30% depreciation.

- After 5 years: 50% depreciation.

- After 10 years: 60-75% depreciation.

How much will my campervan lose over time?

Campervans tend to hold their value well. If it is in good condition and mileage is not too high (eg less than 10,000 miles added) it will drop by about 10% a year over 5 years or so for diesel vehicles and electric ones (for now). Hybrid campers are going up by about 2.25% annually. As EVs become more accepted we expect electric RVs to start to hold or even increase their value over the coming three years. Below is a summary of our findings for resale values as they are now.

Table 1. Summary of RV price changes over time

Should I sell my diesel RV?

Our advice is to look after your camper, choose a fuel that will keep it clean and hold its value – and enjoy it to the max. If you own a diesel campervan now, it might be worth looking to trade it in soon while the market is still buoyant. But don’t leave it too late. As charges and taxes go up for diesel and the roll-out of low emissions zones accelerate, owners will feel the pinch and feel the need to sell.

At some point the number of sellers will far outweigh that of buyers and resale values will drop sharply – to the point many will not be able to sell. This date is not far off and what you buy now will, in all likelihood be affected near the end of your ownership by this trend – which is a sobering thought. Though 2028 may feel like a while away, it is not in campervan years. Hybrid is a good bet. Electric will soon be the better one.

Appendix – the stats

Table 2. Hybrid Eco Campers prices on average show a small but important annual increase in resale prices

| Mileage added | Time Lapsed (days) | Price when new | Price when resold | Depreciation

|

Appreciation

|

Average per year | ||||||

| Hybrid Eco Pioneer I | ||||||||||||

| 3996 | 511 | £35,990 | £37,995 | 6.75% | 5.19% | |||||||

| 21858 | 2284 | £31,850 | £29,995 | 5.82% | -1.16% | |||||||

| 36634 | 1271 | £35,520 | £33,995 | 5.09% | -1.45% | |||||||

| 11488 | 1251 | £43,612 | £38,250 | 12.29% | -3.59% | |||||||

| 27159 | 394 | £29,750 | £29,000 | 2.52% | -2.52% | |||||||

| Avg | -0.71% | |||||||||||

| Petrol Connect | ||||||||||||

| 9041 | 703 | £28,694 | £28,995 | 1.31% | 0.68% | |||||||

| 12283 | 1871 | £19,995 | £19,995 | 0% | 0% | 0% | ||||||

| Avg | 0.34% | |||||||||||

| Hybrid Eco Pioneer II | ||||||||||||

| 3010 | 334 | £52,000 | £53,285 | 2.47% | 2.47% | |||||||

| 6725 | 680 | £47,000 | £49,995 | 6.37% | 3.22% | |||||||

| 1590 | 466 | £52,000 | £53,995 | 3.84% | 2.90% | |||||||

| Avg | 2.84% | |||||||||||